Publisher description

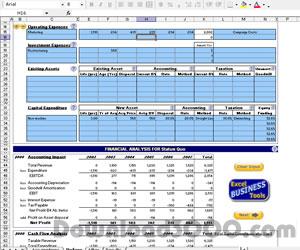

The Investment Valuation model is ideal for evaluating a wide range of investment and business case scenarios. While it is based on the traditional discounted cash flow method of valuation, its also provides ability to evaluate economic value added valuation, accounting impact, and a range of other evaluation parameters. Furthermore, the step-by-step input flow makes usage straightforward, gaining quick results to drive decision-making.

Related Programs

Investment and Business Valuation 3.2

Valuation of investments and business streams

Business Valuation Model Excel 60

Business valuation, 3 year investment return.

Discounted Cash Flow Analysis Calculator 2.1

Discounted Cash Flow Analysis Calculator

MoneyToys Discounted Cash Flow Calculato 2.1.1

Discounted Cash Flow Calculator

Investment Analysis Software 10

Easily analyze investment performance.